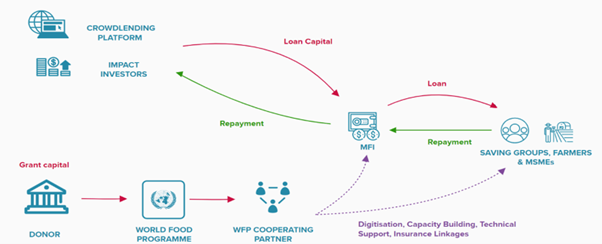

Access to capital is a critical component of breaking the cycle of poverty, particularly for smallholder farmers and micro-entrepreneurs in low-income countries. They often experience financial exclusion despite the presence of Financial Service Providers (FSPs). Local FSPs are financial institutions that usually provide small loans to individuals who cannot access traditional banking services. However, smallholder farmers and rural micro-entrepreneurs are often considered high-risk borrowers by FSPs due to their reliance on seasonal crop harvests for income and their vulnerability to external factors such as climate change and pests. Barriers like insufficient identification, limited credit history, poor access to mobile phones and distance from financial institutions prevent SheCan’s target population from accessing financial services. Moreover, smallholder farmers and micro-entrepreneurs, especially women, often lack the financial literacy needed to navigate the financial system and the tools to securely and transparently deposit and track their savings. This results in a cycle of limited financial opportunities in rural areas, perpetuating the cycle of poverty and having a greater impact on women.

FSPs themselves face high loan servicing costs in rural and remote areas, as they lack the necessary infrastructure and digitization of their processes, which leads to expensive terms for potential clients in these areas. Besides high interest rates and commission fees, excessive collateral requirements often require smallholder farmers to access finance. This requirement disproportionately affects women, as they are significantly disadvantaged relative to men with regard to land rights and inheritance laws.