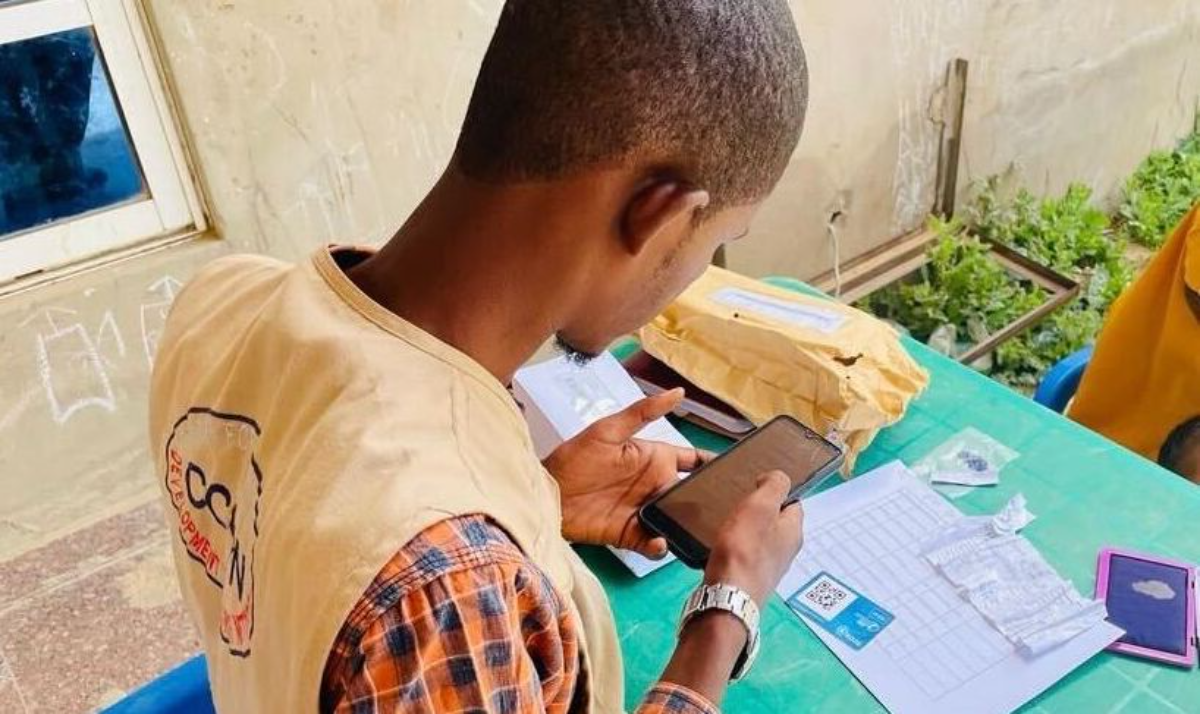

WFP operations often rely on manual processes to perform card distributions and verify people's identities. This results in the use of paper forms and Excel spreadsheets which pose two key problems for field operations: Operational inefficiencies during payment card distribution causing long waiting lines for beneficiaries and Cash assurance gaps caused by manual process data entry errors, operational delays and possible divergence of digital money.